Last update: 28/07/2016

The best of OUB saving accounts at a glance

Passbook Savings Account

A simple savings account that gives you access to a host of banking conveniences.

Benefits

-

Complimentary global ATM Card or enjoy a 3-year fee waiver on your UOB Direct Visa Card

-

Attractive interest rates

-

24/7 access to your Passbook Savings Account through UOB Personal Internet Banking and Phone Banking services

-

Access to UniAlerts which will notify you on your banking activities via email or mobile phone

-

Hassle-free monthly funds transfers to your Passbook Savings Account from any account with UOB or other financial institutions

Interest rate

Link to: UOB Passbook Savings Account for additonal details

Uniplus Account

A statement-based account that comes with all the pluses you need to grow your savings

Benefits

-

High daily interest rates with the convenience of monthly statements

-

Complimentary global ATM Card or enjoy a 3-year fee waiver on your UOB Direct Visa Card

-

24/7 access to your Uniplus Account through UOB Personal Internet Banking and Phone Banking services

-

Access to UniAlerts which will notify you on your banking activities via email or mobile phone

-

Hassle-free monthly funds transfers to your Uniplus Account from any account with UOB or other financial institutions.

Interest rate

Link to: UOB Uniplus Account for additional details

FlexiDeposit Account

Enjoy the full convenience of a savings account and access your savings anytime. Best of all, you earn premium interest on the credit balance

Benefits

-

Statement-based savings account

-

Complimentary global ATM Card or enjoy a 3-year fee waiver on your UOB Direct Visa Card

-

24/7 access to your FlexiDeposit Account through UOB Personal Internet Banking and Phone Banking services

-

Access to UniAlerts which will notify you on your banking activities via email or mobile phone

-

Hassle-free monthly funds transfers to your FlexiDeposit Account from your account with UOB or with other financial institutions

Interest rate

TX Account

The online savings account with real-world perks. Unlike other savings accounts, it lets you enjoy the lifestyle benefits sooner than you can imagine. There's no minimum balance, service charge or papers to deal with. In short, it's all perks and no pain.

Benefits

-

Attractive interest rates

-

24-hour access to your TX Account through our UOB Personal Internet Banking and Phone Banking service

-

No minimum balance and service charges

-

Minimum initial deposit of S$100

-

View bank statements online with e-statements

-

Access to UniAlerts which will alert you on your banking activities via email or mobile phone

Interest rate

Junior Savers Account

An all-in-one account with 12 foreign currencies types and Singapore dollar that lets you save and transact.

Benefits

-

Attractive interest rates

-

Complimentary UOB ATM Card with NETS and PLUS facilities

-

24/7 access to your Junior Savers Account through UOB Personal Internet Banking and 24-hour phone banking service

-

The UOB Junior Savers Account can be converted to a regular statement-based savings account when the child reaches 16 years old at any UOB Group branch.

-

Peace of mind with FREE insurance coverage* - up to 100% of your deposit balance

-

To qualify, you must maintain an average daily balance** of S$3,000 per month over the past six months or since the account is opened, whichever period is shorter

-

The Portfolio Insurance cover is paid as a percentage of the average daily balance** in the Junior Savers Account at the point of parent's (ie, Insured) death or total permanent disability

-

The insurance covers the insured till age 65 or upon the child reaching 17 years old, whichever comes first

-

-

Hassle-free monthly funds transfers to your child's Junior Savers Account from your account with UOB or with other financial institutions

-

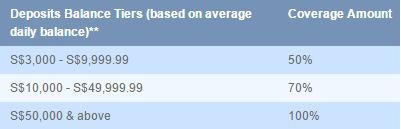

Insurance coverage is based on the following deposit balance tiers

* Insurance terms and conditions apply.

** Average daily balance refers to the average daily balance per month for the past six months or since account opening, whichever period is shorter.

Interest rate

Link to: UOB Junior Savers Account for additional details

One Account

Get higher interest rates of up to 3.33% p.a.^ on your savings when you save with the UOB One Account and spend with your UOB One Card and/or UOB Direct Visa Debit Card.

ENJOY GREATER SAVINGS WITH THE UOB ONE ACCOUNT AND UOB ONE CARD.

Benefits

-

You spend S$500 on your UOB One Card every month for 12 months (where there is no overseas spend)

-

You credit your salary of S$2,000 monthly

-

You maintain a monthly average balance# of S$50,000 in deposits over 12 months.

How it works

Interest rate

♦ Total interest A is equivalent to Base Interest Plus Bonus Interest A. Total interest B is equivalent to Base Interest Plus Bonus Interest B. Base interest is 0.05% p.a.. Bonus interest is paid on first S$50,000 balance in your One Account.

^Maximum effective interest rate (EIR) on the One Account is 1.60% p.a. for deposits of S$50,000, provided customers meet the criteria of S$500 Card Spend. Maximum effective interest rate (EIR) on the One Account is 2.43% p.a. for deposits of S$50,000, provided customers meet both criterias of S$500 Card Spend and S$2,000 salary credit or 3 GIRO debits per month.

+This is based on a spend of S$300, S$800 or S$1,500 monthly for 3 consecutive statement periods with min. 3 purchases to earn the quarterly cash rebate of S$30, S$80 or S$150 respectively. Please refer to full set of UOB One Visa Credit Card Terms and Conditions at uob.com.sg.In the examples, the qualifying quarters are between May - Jul 2015, Aug - Oct 2015, Nov 2015 - Jan 2016 and Feb - Apr 2016.

#Monthly average balance is the summation of each day end balance for each month divided by the number of calendar days for that month.

Link to: UOB One Account for additional details